- Home /

- Cost /

- Accounting /

- Financial Advisor Cost Guide

How much does a financial advisor cost?

Get a free quote nowPrice guide

AED100 - AED400

Last Updated on 28 March 2023

Are you confused about whether to pick a conservatory or an orangery for your home remodelling project? Don’t worry, you are not alone. Because they share many similarities, from the use of glass to purpose, people cannot immediately tell the difference!

This orangery vs conservatory vs extension guide is here to help you. It answers some of your pressing questions, such as which ones increase the value of your existing property, which invites more light and improves energy efficiency, and which lasts longer.

The article also illustrates a simple process of hiring the right architect or designer for the job. So if you are excited to find out their differences, read on!

What factors affect overall financial advisor costs?

Want to make wiser financial decisions? Or just want to prepare for your family’s future? There are different factors to consider when it comes to costs, such as the type of financial advice needed, the location, the delivery of the service, and the state of your finances.

| Financial advice | Estimated cost |

|---|---|

| General advice | Starts at AED100 |

| Full financial plan | Starts at AED100 |

| Estate plan | Starts at AED100 |

Different types of financial advisor fees

In what other areas can a financial advisor help me?

Money is a complex subject, but a financial advisor can help in any financial obligation or project. Aside from investment advice, retirement planning, and at-retirement advice, financial advisors can also help in managing debt, savings, mortgages, and insurances. They can help you create a savings plan to achieve your future financial goals faster. Advisors specialising in mortgages can also negotiate a better deal to help you achieve your future home. They can also help you set up insurance and income protection products with lower fees. Aside from these, they can help you manage your debt and avoid accumulating in the future. Financial advisors can also refer you to other professionals if you need help with bookkeeping, taxes, and other financial matters.

What are the benefits of hiring a financial advisor?

There are many benefits in hiring a financial advisor:

- Hiring a financial advisor ensures you are financially secured during your golden years.

- Hiring a financial advisor gives you the peace of mind that your income is protected especially during life challenges such as illnesses or accidents.

- Hiring a financial advisor helps you arrive at informed financial decisions to avoid fraud and investment losses.

Overall, hiring a financial advisor helps you manage your finances holistically. From planning your finances to executing strategies, a financial advisor is ready to help.

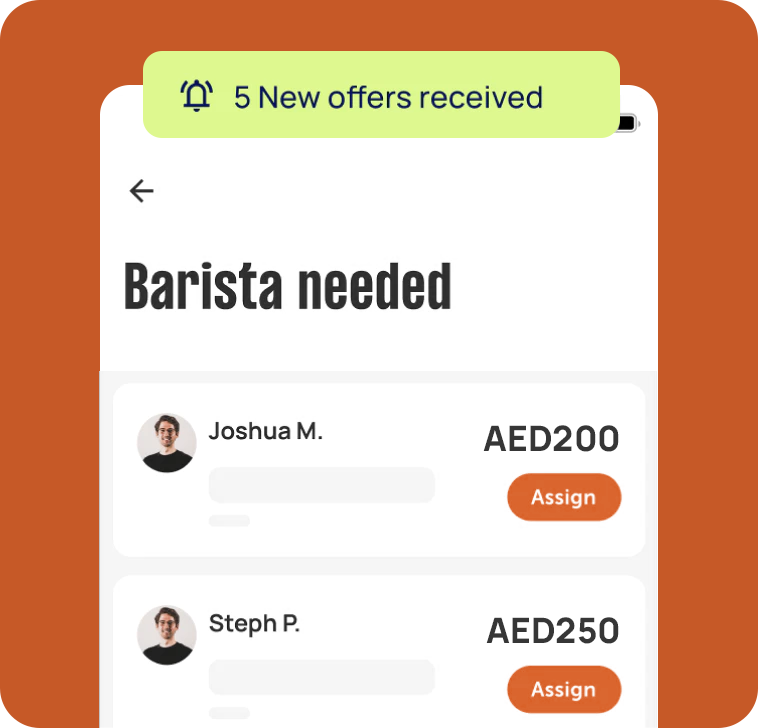

If you are ready to take the next step to financial security, skip the financial advisor cost calculators and get a personalised quote when you put up a task on NearFetch!

Find financial advisors, fast

Post a taskFAQs

Before hiring a financial advisor, check if they have the right professional background, credentials, and expertise to handle your finances. They must be someone you can trust and are within reasonable costs or fees. In addition to these, advisors must have a Financial Adviser Standards and Ethics Authority (FASEA) approved bachelor degree or higher, relevant professional experience, and completion of a national exam set by FASEA. Keep in mind that Independent Financial Advisors don’t work on commission. If they keep pushing for a product before knowing your financial background, chances are they are salespersons.

Hiring a financial advisor will be beneficial if you are in the highest tax bracket or have received a large sum of money and would like guidance to manage these wisely. It will also be helpful if you ever plan to work significant life decisions like starting a business or starting a family. Ultimately, if you feel worried and don’t feel confident handling your finances, it is best to consult with a financial advisor.

Financial advisors and financial planners are both professionals who are experts in money management. Although they can sometimes be interchanged, a financial advisor is the umbrella term for professionals who help you manage your money. In contrast, a financial planner looks at the overall state of your finances and creates a financial plan to help you achieve your future goals. With this, a financial planner is a specific type of financial advisor with expertise in financial planning.

It depends on the type of service that you need. If you need long-term planning such as retirement or wealth management, this would include longer periods. Clarify what your goals are then plan from there.